1.

Don’t rush to buy any property for “fear of missing out”(FOMO). If you are a buyer, the seller may adopt powerful tactics to create a fear in your mind of missing out on the property if it is not purchased immediately. Take your own time, evaluate and compare all your options and take a well-informed buying decision.

2.

Avoid revealing your budget at the very outset. Otherwise there is a high chance that the seller will hike the property price to match your budget.

3.

Undertake a SWOT analysis of the property before you decide to buy it. SWOT refers to Strength, Weakness, Opportunity & Threat. While prominent location of a property could be its Strength, a narrow and dirty approach could be its Weakness. Similarly, while an upcoming metro station close by could be an Opportunity, close proximity of the property to upcoming microwave relay stations or high-tension wires could be a Threat. Needless to add, the Strengths and Opportunities together should outweigh the Weaknesses and Threats for the property to be worthy of your investment.

4.

Exercise due diligence before buying a property. Due diligence includes checking of seller’s Antecedents, verification of original title deeds and chain of title, verification of share certificate, verification of society’s ‘No dues’ & ‘No Objection’ certificates, determination of the market vale of the property and ascertaining the position of encumbrances and litigation on the property, if any.

5.

Ensure that the seller not only has a clear and marketable title to the property but also has full set of original title deeds and effective possession of the property which he/ she is trying to sell. If original title deeds are not available with the seller, the possibility of the property having been equitably mortgaged to some lender as security for a loan, cannot be ruled out. Similarly, if the seller does not have complete and effective possession of the property, the buyer may not be able to get possession of the property even after making full payment and getting the property registered in his/ her name.

6.

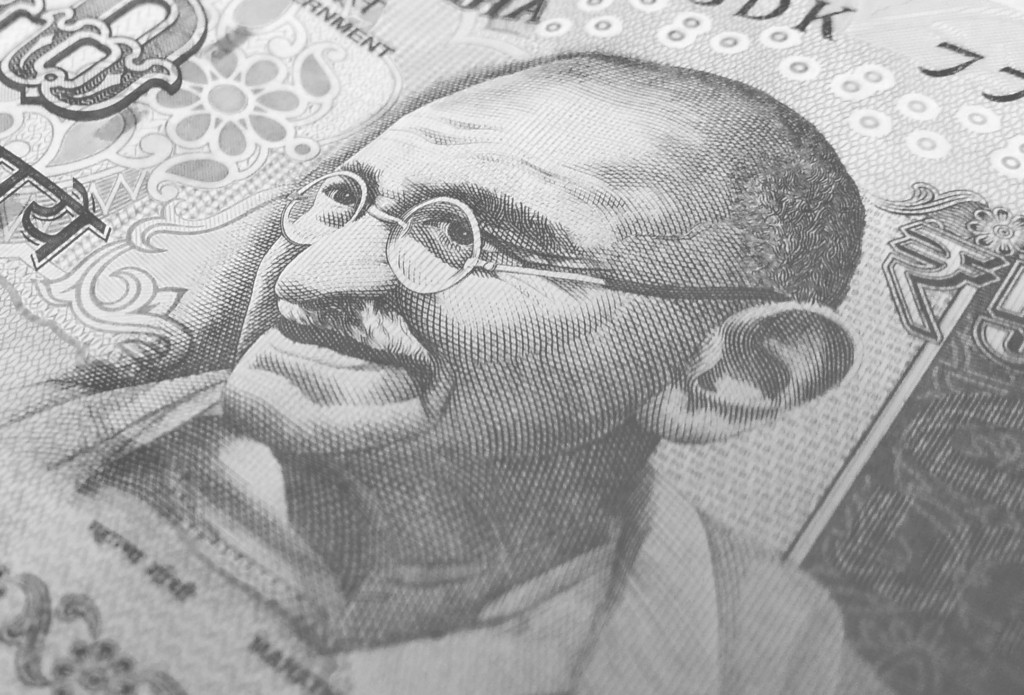

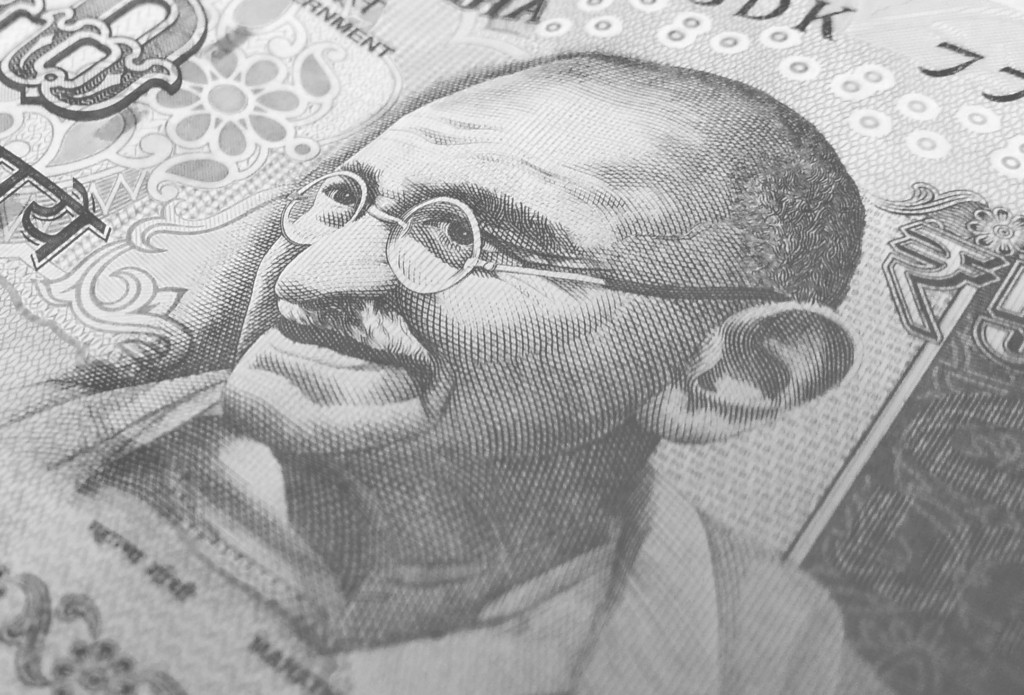

Find out the ready reckoner rate (also known as ‘Circle rate’ or ‘Government rate’) of the property being purchased because the stamp duty will have to be paid at the time of registration of the property in accordance with the ready reckoner rate and not the rate at which the property is actually being purchased.

7.

Check for statutory overdues. Municipal taxes, electricity and water tax, etc. should all be fully paid upto the date of purchase.

8.

Get perfect clarity on the furniture & fixtures that will be transferred to the buyer along with the property at the time of possession.